The 5-Minute Rule for Frost Pllc

Table of ContentsGetting My Frost Pllc To WorkNot known Incorrect Statements About Frost Pllc What Does Frost Pllc Do?Frost Pllc - QuestionsAn Unbiased View of Frost Pllc

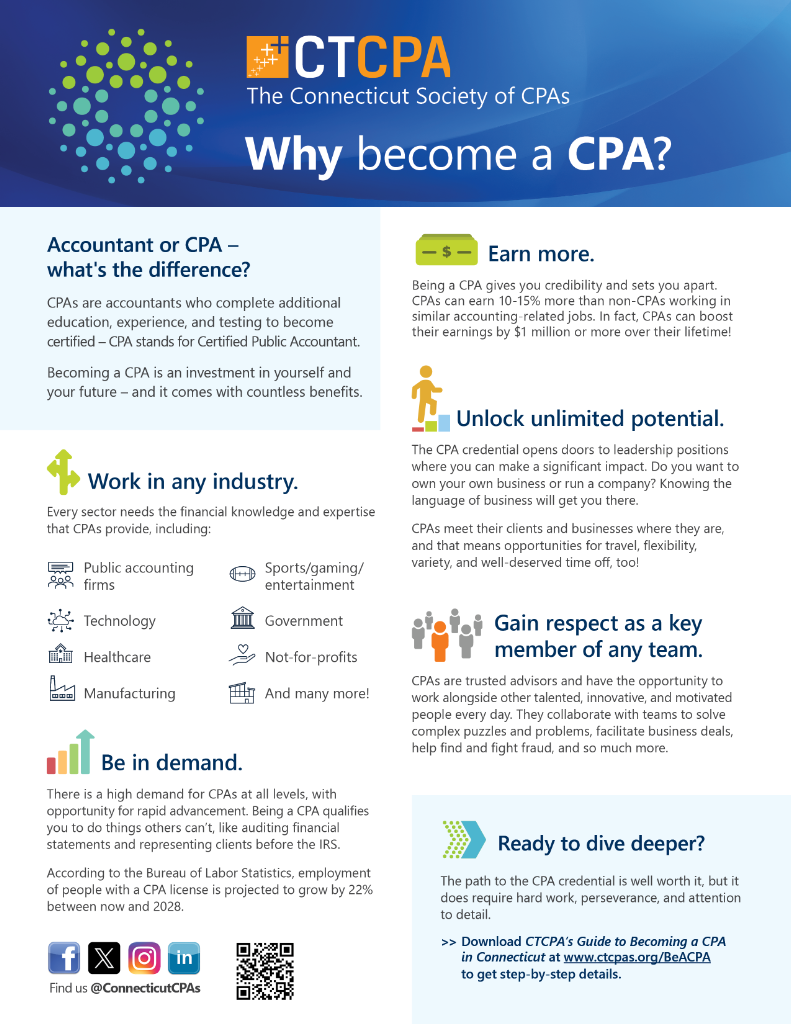

Even if you start in bookkeeping doesn't mean you need to remain in it - Frost PLLC. With so numerous choices comes one more benefit of being an accountant: your abilities will certainly apply to a wide variety of business-related areas. Lots of audit graduates have moved on to end up being CEOs of effective firms after ending up accounting programsYou might pursue an accountancy job in a tiny company or company; you might choose to work for the federal government or the personal industry, or you may even begin your very own business. Accountancy is at the core of the company world, and accounting professionals have some really solid abilities.

, this is especially true for those with audit tasks in the not-for-profit field. Being an accountant is nothing to sneeze at. If you're looking for a respectable occupation that will certainly offer you with beneficial abilities as well as duties, accounting is a terrific field.

If you select to come to be licensed, a certified public accountant certificate will position you in a highly-paid minority and will assist you get started on a secure job with terrific prospects that are not likely to alter in the next years. Continuous proceeding education aids with this security. An accountancy job takes long years in education a minimum of a four-year Bachelor's level, often followed by a 5th year or a Master's level.

More About Frost Pllc

, and your time in college can have an important impact on your future career. This is one more factor to make sure you are getting in the field of accounting for the ideal factors including an authentic affinity for the work.

Bureau of Labor Data, in their Occupational Overview Manual, indicates a strong task outlook for accounting professionals. The mean salary is affordable, and the demand for these specialists has a tendency to stay stable, also in times of economic uncertainty. Accounting professionals function across a series of industries and fields, including personal organizations, federal government companies, and public bookkeeping companies.

Frost Pllc Fundamentals Explained

The typical accounting professional's typical wage has to do with $75,000. The highest-paid 25 percent of employees make much more than this, and there is the opportunity to make six numbers as an accounting professional. Naturally, this relies on the bookkeeping firm you work for, your education and learning, and if you have a CPA qualification.

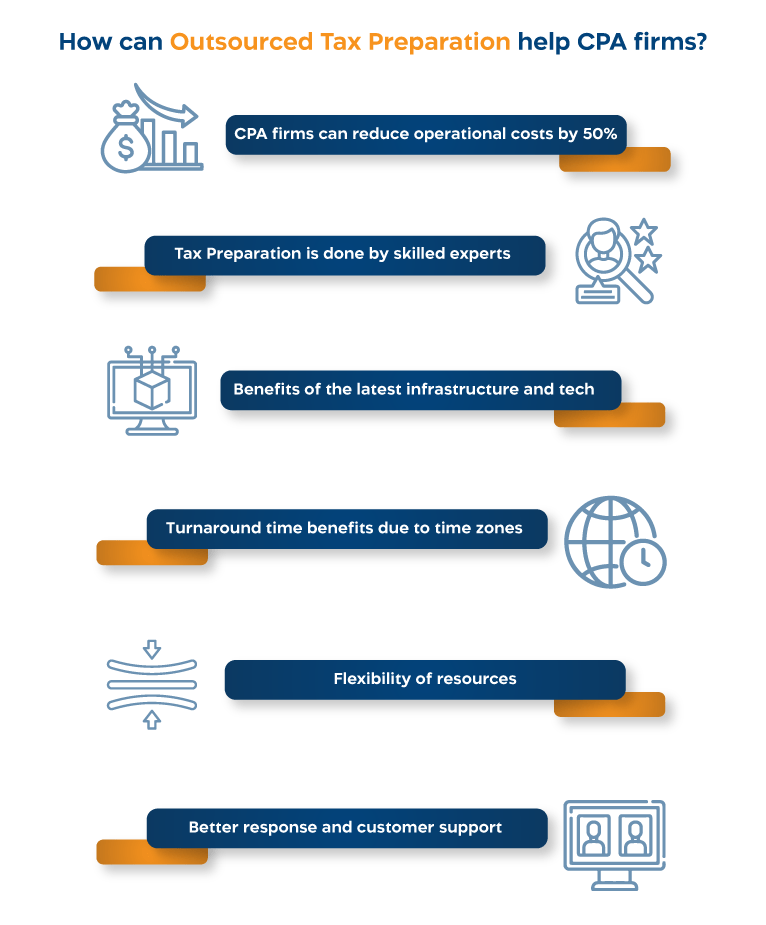

Companies have a whole lot on their plate that they need to handle on a day-to-day basis. Making certain they have the ideal employees to manage operations, making a decision on new advertising and marketing approaches, and dealing with functional troubles, there's always plenty to do. Managing the audit can begin to obtain extra complicated as your company grows, which is why numerous organizations turn to a certified public accountant company to handle this element.

Employing a Certified public accountant company can be exceptionally useful to organization proprietors who are already swamped with all the various other activities entailed in running a service. Hiring a Certified public accountant firm releases up their time and takes those responsibilities off their shoulders so click this link they can focus on their various other service features.

Frost Pllc Fundamentals Explained

You might be happy to learn, nonetheless, that certified public accountant companies Read More Here commonly bring a various point of view based upon their experience with collaborating with various other types of companies that you might not otherwise obtain from an internal team. A CPA company can keep your financials upgraded with the most up to date tax guideline and regulatory adjustments that could affect them.

Companies can really conserve you throughout tax obligation period and also find various other locations of your organization that might be considered for lowering prices. A third event is commonly a better source for keeping track of payments, establishing which costs are unnecessary, and assisting avoid scams within the company. As an entrepreneur, you already have a lots of job that you need to do everyday.

One of the most indispensable components of your company is the financials because it will certainly tell you whether the service is lucrative or not. That's why these jobs need to be taken on with treatment and time. Hiring another person to tackle these duties will really save you a whole lot of time.

With lots of lawful issues that exist with running a company, employing a CPA company that keeps an eye on your deals and activities in an appropriate fashion will be very useful if a legal disagreement occurs. They will have the ability to provide the proofs and ledgers when asked to do so in a deposition or court.

Frost Pllc for Beginners